The High-Rate Puzzle: Assumable Mortgages Are Your Hidden Gem

The High-Rate Puzzle: Why Assumable Mortgages Are Your Hidden Gem

Navigating today’s housing market can feel like running a maze. High interest rates, rising prices, and limited inventory have created a “perfect storm” for buyers and sellers alike. For many buyers, a new mortgage feels out of reach. For many sellers, giving up their low-rate loan to move just doesn’t make sense.

But what if you could hop in a financial time machine and grab yesterday’s low interest rate? That’s exactly what an assumable mortgage allows. It’s a powerful, often-overlooked option where a buyer takes over the seller’s existing mortgage—keeping the same balance, same payoff timeline, and, most importantly, the original (often much lower) interest rate.

This isn’t just a niche trick anymore. With today’s rates holding steady, VA and FHA mortgage assumptions have surged by more than 50% since 2021.

A Win-Win for Buyers and Sellers

For Buyers:

-

The biggest perk is inheriting a much lower interest rate—sometimes 2% to 4% lower than current market rates.

-

That can translate into thousands of dollars in lifetime savings, and hundreds of dollars each month.

-

Buyers may also save on some closing costs, since they aren’t originating a brand-new loan.

For Sellers:

-

Offering a home with a low-rate assumable mortgage is a huge marketing advantage.

-

It attracts more buyers, makes your listing stand out, and often helps you negotiate closer to your asking price.

The Catch: If the home’s value has increased, there’s usually an “equity gap” between the sale price and the remaining loan balance. Buyers must cover that difference, either in cash or with a second mortgage.

Real-World Example

Many loans were written during the “golden years” of ultra-low rates. Nationally, about 21% of mortgages are below 3% (CFPB/FHFA), and an even larger share is below 5%.

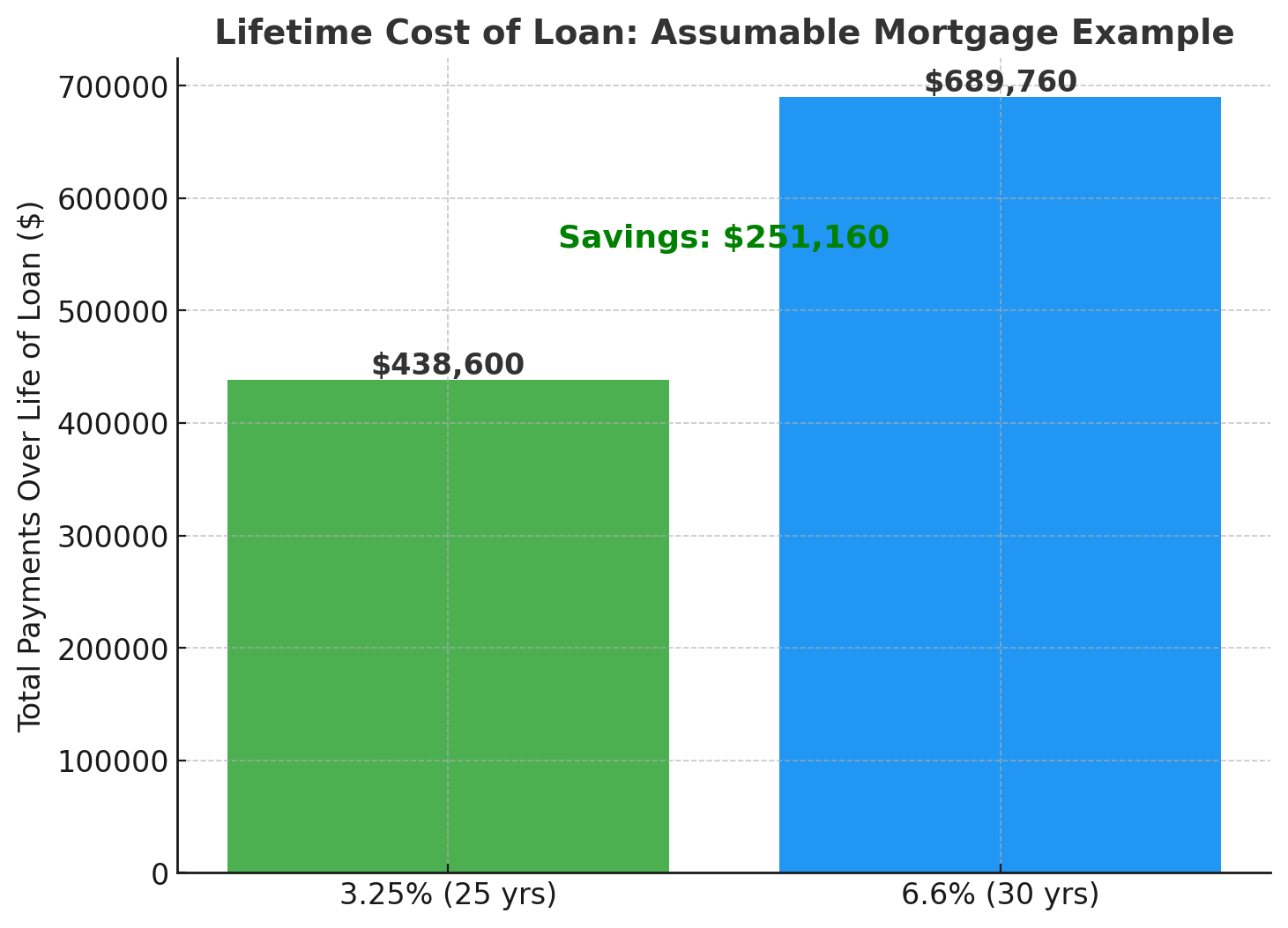

Quick math:

-

$300,000 loan at 3.25% (25 years left) = ~$1,462/month

-

$300,000 loan at 6.6% (30 years) = ~$1,916/month

That’s about $450 more every month—or more than $5,000 a year.

What Types of Loans Are Assumable?

Not all loans qualify. Most conventional mortgages have a due-on-sale clause—meaning they must be paid off when the home sells. But several government-backed loans are designed to be assumable:

-

FHA Loans – All FHA-insured mortgages are assumable, but the buyer must undergo full credit and income qualification and must plan to live in the home as their primary residence (HUD).

-

VA Loans – VA loans are assumable by any qualified buyer—even non-veterans. The key for sellers is their VA entitlement. If a non-veteran assumes the loan, the seller’s entitlement stays tied up until the mortgage is paid off. That’s why many veterans prefer another veteran as the buyer.

-

USDA Loans – Also assumable, but the buyer must meet program rules, such as using the property as their primary residence and meeting income limits.

Myth-buster: An assumable mortgage does not mean skipping qualification. The buyer must still be approved by the loan servicer, with normal credit, income, and debt-to-income checks.

Who’s Eligible (Plain English Version)

-

Buyers must qualify with the current servicer (not just the agent). Expect paperwork, income checks, and standard underwriting.

-

Sellers should always request a formal release of liability at closing. For VA loans, this may involve specific forms, and veterans should ask early about substitution of entitlement.

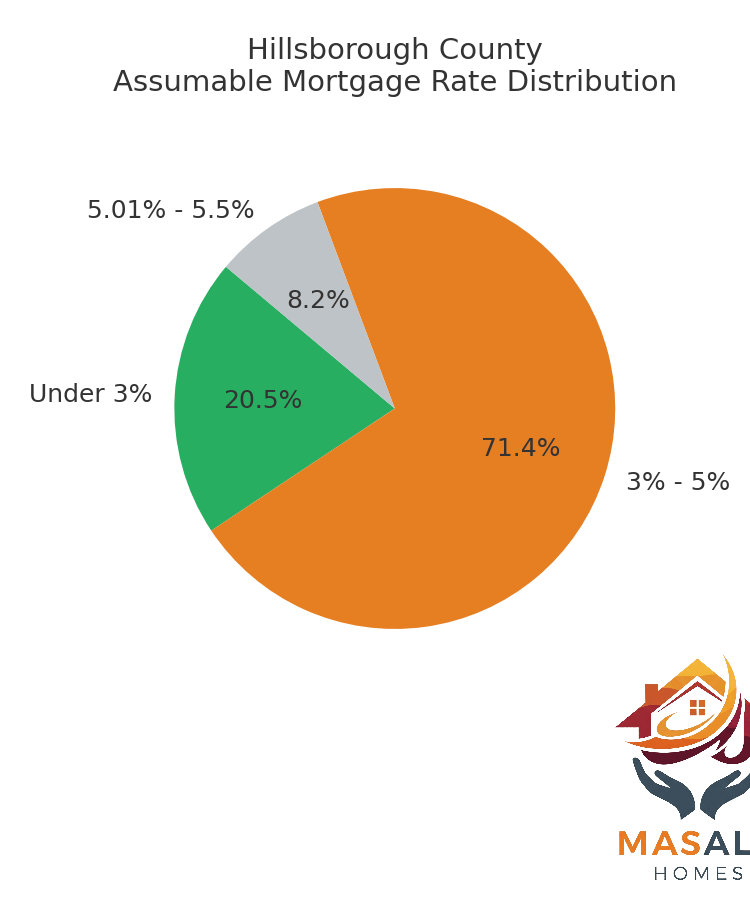

Tampa & Hillsborough County Snapshot

When talking about assumable mortgages, the big question is: How many are actually available here, today? Dedicated marketplaces like Roam now track these listings, giving us real-time visibility.

-

Hillsborough County: ~1,094 active homes advertising assumable mortgages

-

City of Tampa: ~403 active homes with assumable mortgages

Many of these loans are in the 2.9% to 4.9% range—well below today’s market averages.

Ballpark Rate Buckets (Hillsborough)

-

Under 3%: ~200–250 homes

-

3%–5%: ~750–820 homes

-

5.01%–5.5%: ~70–110 homes

This breakdown shows just how much hidden opportunity is sitting in the local market—opportunity most buyers and sellers don’t even realize exists.

Pros & Cons at a Glance

Pros

✔ Keep a lower rate (save hundreds per month)

✔ Potentially lower upfront costs (VA/USDA especially)

✔ Shorter remaining term if assuming an older loan

Cons

✘ Must qualify with the servicer (not automatic)

✘ May need cash or a second loan for the equity gap

✘ FHA MIP and USDA fees/terms carry over

✘ Conventional fixed-rate loans usually aren’t assumable

How Masala Homes Can Help

Assumable mortgages are powerful—but they can also be complex. That’s where we come in.

-

For Buyers: We help you identify assumable homes, confirm details with lenders, and model your true cash-to-close so you know exactly what you’re walking into.

-

For Sellers: If you have an assumable loan, we’ll highlight it in your marketing, attract more qualified buyers, and coordinate with your lender to get you released from liability after closing.

At Masala Homes, we’re here to make sure you take full advantage of this hidden opportunity—while protecting your interests every step of the way.

Conclusion

Assumable mortgages are one of the smartest tools in today’s market. Buyers can grab yesterday’s low rates. Sellers can stand out with a unique advantage. Yes, there are details to navigate—like qualification and equity gaps—but with the right guidance, both sides can win.

FAQs

Do I have to be military to assume a VA loan?

No. Non-veterans can assume VA loans if they qualify—but sellers should understand how their entitlement will be handled.

Is an appraisal required?

Often not for VA assumptions (though some lenders may still request one). FHA and USDA follow program rules and lender overlays.

Can investors assume?

FHA and USDA loans are generally for owner-occupants. Some older loans may have different rules—always confirm with the servicer.

Disclaimer

This blog is for informational purposes only and should not be considered financial or legal advice. Mortgage assumptions involve lender approval, program-specific rules, and legal documentation. Always consult with your lender, attorney, or financial advisor before making decisions.

Sources

Categories

Recent Posts

Smart Moves Start With Smarter data

Masala Homes At HomSmart