Gold's Sky-High Prices: A Signal for Real Estate?

Gold's Sky-High Prices: A Signal for Real Estate?

Hey there, folks. If you've been glancing at the headlines lately, you've probably seen gold smashing through record after record. As someone who's spent years on Wall Street navigating these markets, I wanted to share my thoughts on what this means—especially for real estate.

Full disclosure: This isn't investment advice. Markets are unpredictable, and I'm just breaking it down based on patterns I've seen. My goal? Give you straightforward insights so you can form your own opinions and make smart choices. Let's dive in.

Gold's Wild Ride Right Now

As of October 20, 2025, gold is trading around $4,316 per ounce, extending its streak of record highs. That’s a massive leap from roughly $2,000 just a couple of years ago. Could it keep climbing? Absolutely, but don’t bet the farm. Gold can be volatile, and a short-term dip toward $3,700 wouldn’t surprise me. Over the long run, though, the trend still looks upward.

So why should home buyers or sellers care? Because gold isn’t just shiny jewelry, it’s a signal. When gold moves like this, it usually means there’s something shifting in the broader economy, and that can directly affect real estate, from mortgage rates to home prices.

Why Gold's Surge Matters for Real Estate

Here’s the interesting part: the value of the U.S. dollar has been slipping lately. And when the dollar weakens, real assets like homes often rise in price. Put simply, it takes more dollars to buy the same house.

You might say, “Well, prices of eggs went up recently but came back down later. Isn’t gold or housing the same?” Maybe, but there’s a big difference. Real assets like gold, land, and homes are limited in supply. Unlike the items you find at the grocery store, you can’t just make more of them, which is why their values tend to hold up better over time.

Gold’s surge is really a reflection of that weakening dollar and possibly a hint of what’s ahead: continued softness in the currency.

So why is the dollar losing strength? The short answer is that it’s partly by design. A weaker dollar makes U.S. exports more competitive, and that is something the administration believes in and generally supports. But there’s more to the story than just trade policy...

The Economic Drivers Behind the Scenes

From my experience, gold doesn't rocket up without reasons. There are many reasons, and I don't pretend to understand all of them. Two big ones though tie directly to real estate: inflation and government spending.

Think of it as the rate at which your money loses buying power. If inflation is 3%, the basket of goods you bought for $100 last year now costs you $103.

First, let’s talk about inflation. Recent data shows U.S. inflation is still around 3%, not falling as fast as many people hoped. Gold often rises when inflation is high because it tends to hold its value. Think of it like this: if you had one bar of gold before the pandemic, that same bar could still buy about the same things today. But if you had kept cash instead, it wouldn’t go as far now. Gold’s steady climb suggests that markets expect inflation to stick around, which makes real assets—things you can actually see and touch—more appealing.

Second, deficits. The U.S. government's been spending big, with the 2025 deficit hitting $1.8-2 trillion. This floods the economy with dollars, potentially weakening the dollar. Gold thrives in that environment as a safe haven. Bottom line weakening Dolloar => higher prices for real assets.

Deficit: When a government spends more money than it collects in taxes. To cover the gap, it prints more money or borrows, which can devalue the currency.

Safe Haven: An asset that's expected to keep or grow its value during economic chaos. Investors flock to them when uncertainitty rises.

Balanced view: Not everyone agrees these are the top drivers for the recent jump in gold price —geopolitics and central bank buying play roles too. But if inflation sticks or deficits grow, expect more upward pressure on prices for tangible goods.

A Look Back: History, Ratios, and What They Tell Us

The correlation between gold and home prices isn't ironclad—it's moderate, around 0.6 over decades, meaning they often move together but not always. In the 1970s inflation era, both surged. Post-2008 crash, gold soared while homes tanked. Lately, gold's outpaced real estate.

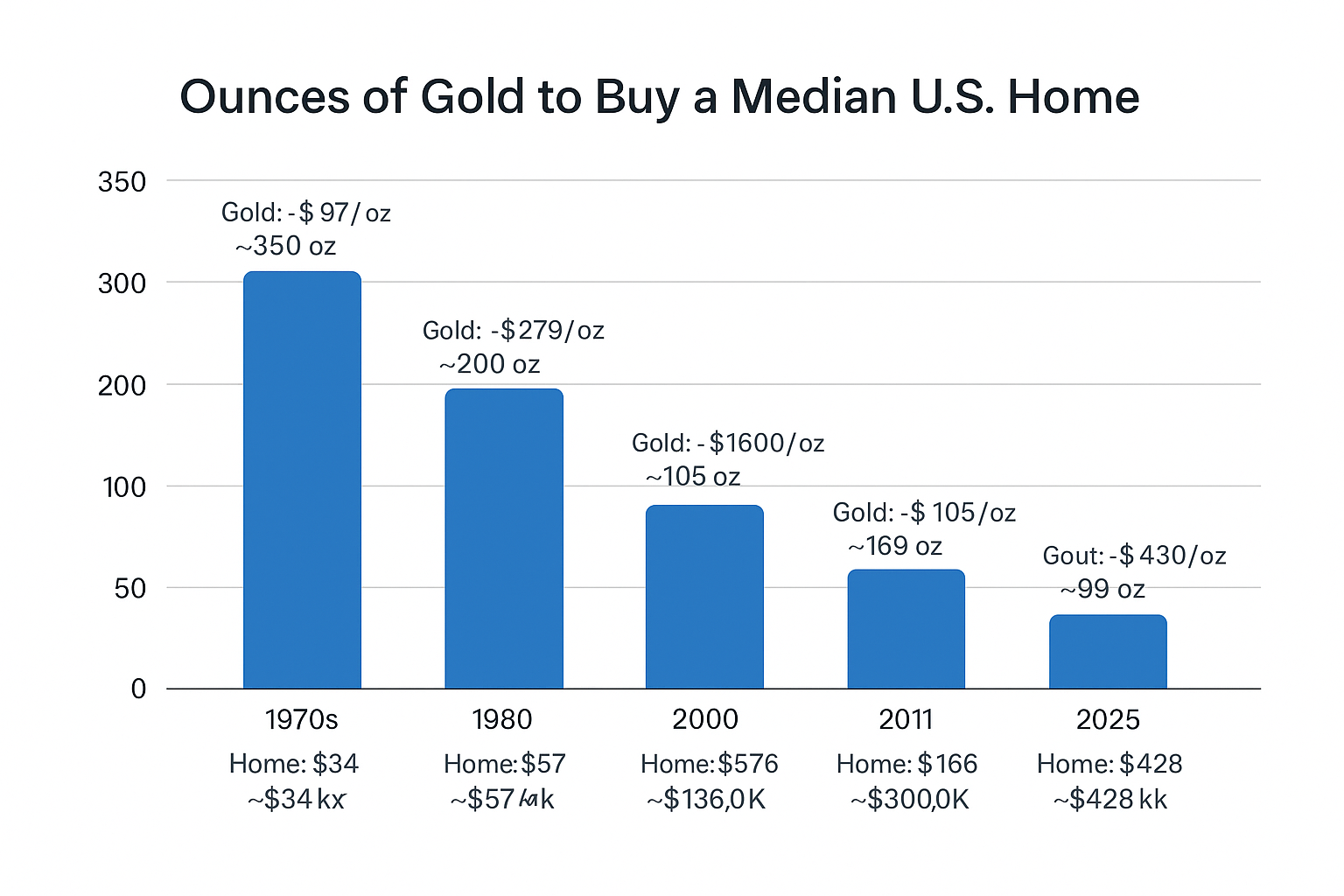

A better gauge than just prices is the median house-to-gold ratio. It essentialy says how many ounces of gold you woud need to buy a median home. Historically, it averages around 218 ounces of gold to buy a median home. Right now, it's roughly 99 ounces—near historic lows. That suggests homes are "cheap" relative to gold, potentially setting up for home prices to catch up.

A simple metric to see if houses are expensive or cheap compared to gold. It's calculated by dividing the median home price by the price of one ounce of gold. A low number suggests homes are a better value relative to gold.

Ounces of Gold to Buy a Median U.S. Home

1970s – Around 350 ounces to buy a home

When President Nixon ended the gold standard in 1971, gold prices jumped from about $35 to over $300 an ounce. Home prices also went up, but not as fast. It took roughly 350 ounces of gold to buy an average home during that decade.

1980 Peak – Around 200 ounces to buy a home

Gold hit $850 an ounce during high inflation and global tensions. Suddenly, it took far fewer ounces of gold to buy a home, only about 200. Homes looked cheap compared to gold, and housing prices rose quickly in the following years.

2000 – Around 450 ounces to buy a home

By the early 2000s, gold had dropped to about $279 an ounce while homes cost around $189,000. It took nearly 450 ounces of gold to buy an average house. Gold looked inexpensive at that point, and its price soon began to climb again.

2011 After the Housing Crash – Around 100 ounces to buy a home

After the 2008 financial crisis, home prices fell to about $166,000 while gold rose to more than $1,500 an ounce. It took only about 100 ounces of gold to buy a home. That was near the bottom for housing, and prices recovered strongly in the years that followed.

2020 – Around 150 to 200 ounces to buy a home

During the pandemic, both gold and home prices increased. Gold averaged about $1,770 an ounce, and homes cost around $300,000. It took roughly 150 to 200 ounces of gold to buy a typical home.

2025 – Around 99 ounces to buy a home

Today, gold is near record highs at more than $4,300 an ounce, while the median U.S. home costs about $428,000. It now takes only about 99 ounces of gold to buy an average home, far below the long-term average.

This low ratio has often signaled shifts where real estate gains ground. Key takeaway: History shows both gold and real estate are solid inflation fighters, but real estate edges out with income potential (rents) and utility. Gold's quick and liquid; homes are slower but build wealth over time.

My Take: What Does This All Mean?

Right now, gold’s high price partly reflects a rush of speculators trying to make a quick profit. That means a pullback in the near term is quite possible and likely. Over the long run, though, I still expect gold to trend higher.

The housing market, especially in our area, is in a transition phase. Prices may stay steady or even dip slightly for a while. So I wouldn’t rely on gold prices as a short-term signal for buying or selling decisions over the next 6 to 12 months.

In the long term, it all comes down to what you believe about inflation and government spending. If you think both will fall, then gold prices — and likely home prices — could drop. But if inflation stays sticky and government deficits keep growing (which I personally believe), then both gold and real estate values are likely to move higher over time.

Bottom line: Gold is just one clue about where housing might be headed. Historically, when gold rises for extended periods, home prices eventually follow.

So is now a good time to buy or sell? It depends on your goals and your time frame. If you plan to hold your home for at least five to eight years, you’ll probably do just fine. If the property fits your lifestyle and long-term plans, this gold rally could be a green light — the odds may be tilting in favor of owning real estate. And remember, very few people ever catch the absolute bottom or top of the market. Those who try usually miss out.

A quick word of caution: Inflation hedges like real estate do come with risks. Economic slowdowns can cool the market, prices can swing in the short term, and real estate isn’t as easy to sell as stocks.

Ultimately, you need to arm yourself with data, talk to pros, and decide based on your own situation. Markets reward patience, not panic.

What do you think? Drop a comment if this sparks ideas. Stay informed, stay smart.

Categories

Recent Posts

Smart Moves Start With Smarter data

Masala Homes At HomSmart